In order to guarantee the security of your data, all users of our new website must create a new login and password. Your login and password from our previous site will not work.

This means that if you have not yet registered on our new website, you will need to do so. It only takes a minute, we promise!

However, this will guarantee you have access to a more personalised and secure view of the orders you place with Castle. In addition, we are working on further improvements that will allow you to do more from your Dashboard, include paying invoices and saving you more time when placing orders.

Please note that if you have already registered on the new site, there is nothing further for you to do.

Also, if you do register but don’t receive the email asking you to verify your registration, please check your Spam/Junk folder. Often, these types of emails end up in there.

If you have any questions about registering on our site, please give us a call on 03 9898 6666.

In order to guarantee the security of your data, all users of our new website must create a new login and password. Your login and password from our previous site will not work.

This means that if you have not yet registered on our new website, you will need to do so. It only takes a minute, we promise!

However, this will guarantee you have access to a more personalised and secure view of the orders you place with Castle. In addition, we are working on further improvements that will allow you to do more from your Dashboard, include paying invoices and saving you more time when placing orders.

Please note that if you have already registered on the new site, there is nothing further for you to do.

Also, if you do register but don’t receive the email asking you to verify your registration, please check your Spam/Junk folder. Often, these types of emails end up in there.

If you have any questions about registering on our site, please give us a call on 03 9898 6666.

FAQs

Stamp duty

-

What is stamp duty and where do you have to pay it?

Stamp duty is a tax imposed by certain States on documents or transactions that affect or record:

- the transfer of the ownership of assets (eg land, cars), or

- the creation of rights in respect of assets (eg certain leases and the creation of a trust).

State/Territory

Discretionary & Unit Trusts

Super Funds

Duty Payable on Original

Duty Payable per Counterpart

Must Be Stamped Within

ACT No No - - - New South Wales Yes No $500 $10 90 days from date of deed Northern Territory Yes Yes $20 $5 60 days from date of deed Queensland No No - - - South Australia No No Nil - but deeds will be stamped if requested Nil - but deeds will be stamped if requested - Tasmania Yes Yes $50 $0 90 days from date of deed Victoria Yes No $200 $0 30 days from date of deed Western Australia No No - - - -

Does my SMSF have to pay stamp duty?

Stamp duty on superannuation fund deeds is only required in Northern Territory and Tasmania. This table illustrates all stamp duty details.

Companies

-

What is a CAS file?

A CAS file is a zip file which holds the information regarding the initial registration details of your newly formed company. Accounting practices often require a CAS file because they use BGL’s software to store corporate records. The CAS file will connect with BGL to add your newly formed company's details to BGL. There is an option to order a CAS file on our order forms. Note that Castle provides a CAS file as a courtesy to clients at no additional cost.

-

Why is my company name on my paperwork in title case, but in capitals on my Certificate of Registration?

Regardless of how you request for your company name to appear, ASIC will only issue a Certificates of Registration with your company name in capitals. So while the rest of your paperwork may show your company name in title case (or however you requested it to appear), your Certificate of Registration will always show it in all capitals. It cannot be requested any other way. Please note that all other documents can have your company name exactly as you wish it to appear, as long as it has been approved by ASIC.

-

When is the best time to deregister your company?

If you know that you would like to deregister your company, it’s a good idea to do it in time so that you can avoid paying the ASIC annual review fee (which, for proprietary companies, is $243). To ensure that you leave yourself enough time, we recommend that you start the process by submitting a Voluntary deregistration form to us within one week of receiving your annual statement from ASIC. This allows time for ASIC to post the deregistration online in the Insolvency Notices and for us to do the necessary administration to deregister your company.

-

Why are common seals no longer included in company packages?

As of 1 July 2014, Castle Corporate no longer offers common seals as a standard inclusion in our company packages. To explain the reasoning behind this change, we thought we would give you a little bit of background to the seal.

The history of the common seal

A common seal was once used as a form of proof by a company that it had formally and legally executed a document. Until 30 June 1998, the use of a common seal to execute solemn or formal documents was compulsory. However, as part of the Costello-led corporate law reform process, and as embodied in the Corporate Law Review Act 1998, the use of a common seal by a company was made optional. That Act stated that:"A company is not required to have a common seal. If it does, the seal must show the company's name and its ACN. The seal is equivalent to the company's signature and may be used on important company documents such as mortgages."

Many organisations took years to adjust to that new relaxation in the law. The worst offenders were government instrumentalities who, in some cases, did not accommodate that change for 8 to 10 years. Now, some 16 years later, the vast majority of organisations and individuals are familiar with, and comfortable about, accepting a document executed by a company without a common seal.Benefits of not using a common seal

The ordering of common seals when setting up a company has become less and less popular over the years. And for good reason. This new approach means:- lower costs for the company owners

- the ability to receive the company documentation faster

- no-one needs to worry about the location of the seal, and

- no need for ink pads and other inconveniences.

What if I still want to order a seal?

While common seals have become less popular, that does not mean we will stop offering them. Common seals can be ordered for an additional fee, either:- when ordering a company or a change of company name – simply select it as a package option on our company order form, or

- separately – send us an email to castle@castlecorp.com.au.

-

How many shareholders do I need in a company?

The option to have a single shareholder for a Australian proprietary company has been available since December 1995. You must have at least one shareholder during the lifetime of your company.

-

What is a public officer?

The public officer in a company is the primary contact for the Australian Taxation Office (ATO). You must advise the details of the public officer to the ATO within three months of commencing trade. This can be done when applying for your Australian Business Number (ABN).

-

Do I have to provide the residential address of all officers?

Yes. This is a legal requirement, as specified in s117 of the Corporations Act 2001. There is a process you can follow to apply to have your residential address suppressed, whereby you are granted ‘silent enroller’ status by the Australian Electoral Commission. Read more about this on the ASIC website: Application for suppression of residential address.

-

Can a person under 18 be an officer of an Australian company?

No. Minors under law cannot hold a position in a company as an officer.

-

Do I have to have a secretary?

Not for a proprietary company. Since 2000, the office of secretary has been optional for Australian proprietary companies. Even so, ASIC requires to be notified of an appointment or resignation of a company secretary. We can assist you. Simply fill in this form and email it back to us. However, public companies are still required to have one secretary who must reside in Australia.

-

What do company directors do? Can I just appoint a spouse or a friend as a director?

Directors are responsible for the proper and prudent operation of the company and are the primary decision-makers. Unless they will be actively involved with the business, it is usually not a good idea to appoint your spouse or friend as a second director of a company. It is important to note that when it comes to statutory duties and obligations, ignorance is not accepted as an excuse for non-compliance. If you wish to make any changes to the directors of a company, we can help. Simply fill in this order form and email it back to us.

-

Why does a director have to be resident of Australia?

It is a requirement under Section 201A of the Corporations Act (2001) that all Australian proprietary companies must have at least one director who resides in Australia. Because of this rule, ASIC will not allow a company to either be registered or owned by only foreign residents. You can view where the Corporations Act references this requirement here.

-

Can I form a company with one director?

Yes – for a proprietary company. Since December 1995, Australian proprietary companies have been allowed to register with a sole director (who must live in Australia). Public companies must have a minimum of three directors (two of whom must reside in Australia).

-

Do you provide a common seal? Do I need one?

Australian companies are not required to have or use a common seal. The requirement was removed in 1998. Many people continue to order common seals, but their popularity has declined over the last 10 years or so. However, if you would like a common seal, they come included in our Premium and Standard packages. If you do not want one, $16.50 will be deducted from your package fee. For our Electronic packages, you can choose to add one to your order for an additional $27.50.

-

What are the replaceable rules?

The replaceable rules are a collection of about 40 sections extracted from the Corporations Act 2001 that give a general framework for running an Australian company. These rules govern the internal relationships of officers and shareholders, but do not cover more practical rules relating to how a company is run on a day-to-day level. To read more about constitutions and the replaceable rules and to determine the suitability of both for your company, please read this page on the ASIC website: Constitution and replaceable rules.

-

Do you provide a constitution?

The constitution contains the rules and procedures that determine how the company is run, making it a very important document. All companies produced by Castle Corporate are provided with our up-to-date constitution in PDF format. If you choose our standard package, two bound copies of the constitution are included. Our premium package includes four bound copies. What are the replaceable rules?

-

Who can register an Australian company?

Practically anybody can register an Australian company, provided they comply with the ASIC Guidelines for registration. Primarily, you need at least:

- one resident director

- one shareholder, and

- a physical Australian address for the registered office of the company.

-

What are the legal elements of a company?

A proprietary company name must include one of the following legal element combinations:

- Pty Ltd

- Proprietary Limited

- Proprietary Ltd

- Pty Limited

- Pty. Ltd.

-

What makes a company, a company?

The general characteristics of a company are:

- it is a corporate body created by law

- it has all the powers of an individual and a corporation

- it can sue and be sued in its own right

- it has officeholders (director(s), secretary(ies))

- it has a registered office

- it has member(s).

Ordering

-

What is a CAS file?

A CAS file is a zip file which holds the information regarding the initial registration details of your newly formed company. Accounting practices often require a CAS file because they use BGL’s software to store corporate records. The CAS file will connect with BGL to add your newly formed company's details to BGL. There is an option to order a CAS file on our order forms. Note that Castle provides a CAS file as a courtesy to clients at no additional cost.

-

Why doesn't my old login work on your website?

The new website we launched back in mid-May gives you greater access to information about the orders you’ve placed with Castle, including the ability to view your orders (and therefore your clients’ private information).

In order to guarantee the security of your data, all users of our new website must create a new login and password. Your login and password from our previous site will not work.

This means that if you have not yet registered on our new website, you will need to do so. It only takes a minute, we promise!

However, this will guarantee you have access to a more personalised and secure view of the orders you place with Castle. In addition, we are working on further improvements that will allow you to do more from your Dashboard, include paying invoices and saving you more time when placing orders.

Please note that if you have already registered on the new site, there is nothing further for you to do.

Also, if you do register but don’t receive the email asking you to verify your registration, please check your Spam/Junk folder. Often, these types of emails end up in there.

If you have any questions about registering on our site, please give us a call on 03 9898 6666.

In order to guarantee the security of your data, all users of our new website must create a new login and password. Your login and password from our previous site will not work.

This means that if you have not yet registered on our new website, you will need to do so. It only takes a minute, we promise!

However, this will guarantee you have access to a more personalised and secure view of the orders you place with Castle. In addition, we are working on further improvements that will allow you to do more from your Dashboard, include paying invoices and saving you more time when placing orders.

Please note that if you have already registered on the new site, there is nothing further for you to do.

Also, if you do register but don’t receive the email asking you to verify your registration, please check your Spam/Junk folder. Often, these types of emails end up in there.

If you have any questions about registering on our site, please give us a call on 03 9898 6666.

-

The 'Submit' button on your PDF order forms aren't working. Why?

Our editable PDFs allow you to complete and submit order forms via a simple button at the bottom of the order form, you can save and print the completed form by using the program that opened the PDF form. However, some clients have experienced some issues using the submit button. This seems to primarily be an issue for those who use Chrome as their browser. Chrome includes a plugin for viewing PDF files, which is designed so that you can view PDF files faster. Unfortunately, the plugin is basic and lacks many useful features like pagination and bookmarks. It also prevents Castle's editable PDF forms from being submitted online. To get around this issue, you will need to turn the plugin off and use the standard Acrobat reader software to submit our forms. To do so, type about:plugins into your browser bar, then look for the plugin called Chrome PDF viewer. Click on the Disable link. After doing this, when you click on a PDF, it will be downloaded and open in Adobe for easy viewing, filling in and submitting to us. If you have any other issues with the form, please let us know by calling 03 9898 6666. We'll be happy to help.

-

How can I check the status of my order?

You’ll be able to check the status of your order at any time. Simply log in to your Member Area and you will be able to see the status of your orders on the homepage of your Dashboard.

-

What happens once I have submitted my order form? How long does it take?

Once you have submitted and paid for your order, we will immediately begin processing it:

- First, one of our experienced staff will manually review your order to ensure all of the details are correct for processing.

- Next, we will register your company with ASIC.

- Finally, we will produce all of your required documents. Once these are completed, we will email you the documents in PDF format.

- If you have ordered one of our print packages, we will professionally print and collate your documents. Then we will send your documents either via courier or Express Post, depending on your location. Most clients will receive their printed order within one business day.

-

What types of payment do you accept? Do I have to pay when I order?

Before we can begin work on your order, we require payment by one of the following methods:

- Credit card – with Visa, MasterCard or Amex

- BPAY

Approved clients also have an additional option

-

Pay in 30 days via credit card or BPAY (see your invoice for details)

If you have any questions about payment, please give us a call on 03 9898 6666 or email us.

-

Do I have to register to place an order online?

Yes. We require you to register in order to make it quicker and easier to complete your order. Registration is free and takes only a minute.

-

Lots of companies promise to deliver my documents to my inbox immediately. Why can't you be that fast?

While in many industries speed is an asset, in ours, we think it can be a liability. When placing an order, something as simple as mistyping the new company’s name can cost a client hundreds of dollars to correct with ASIC. Even worse, if your client chooses a name for their new company that is similar to another company, ASIC may approve it. But down the road, the other company with the similar name could enter into legal proceedings demanding that your client change the company name. This could cost your client thousands of dollars in legal fees, rebranding, sign writing and new advertising. That is why we have one of our specialist team members manually review every single order. If we see something that we think could become an issue or may be an error, we’ll give you a call to discuss it and confirm how you would like to proceed. We believe that by doing this, we add value to you and your clients. This is part of our goal to truly partner with you to get your order right, every time. And this is why our clients tell us they keep coming back. So while our software has the capability to immediately process your order, we insist on taking that little bit longer to have a personal look at your order and make sure it looks right to us. While this means that we don’t have your documents to you in minutes, we still get them to you in a very short amount of time. Assuming there are no issues with your order, you’ll usually have a PDF of your documents in your inbox within a few business hours. If you’ve ordered one of our printed packages, you will normally receive your professionally presented documents within one business day.

-

How long will it take to register my company?

At Castle Corporate, we carefully review each order. If there is a suspected issue or error in your application, we can work with you to address it before proceeding. Assuming there are no issues with your order, you’ll usually have a PDF of your documents in your inbox within a few business hours. If you have ordered one of our printed packages, you will normally receive your professionally presented documents within one business day. Note: There are some things that may slow down how quickly your application can be processed:

- if your company name is (or is considered by ASIC to be) identical to a currently registered company or business name

- if you own a business name and are registering your company with the same name

- if your company name contains restricted words (eg. bank, royal, guarantee, etc.)

- if your company name contains words that may be considered offensive or suggest illegal activity.

ACNs - Company names

-

Why is my company name on my paperwork in title case, but in capitals on my Certificate of Registration?

Regardless of how you request for your company name to appear, ASIC will only issue a Certificates of Registration with your company name in capitals. So while the rest of your paperwork may show your company name in title case (or however you requested it to appear), your Certificate of Registration will always show it in all capitals. It cannot be requested any other way. Please note that all other documents can have your company name exactly as you wish it to appear, as long as it has been approved by ASIC.

-

Can I change my company name?

Yes, the members of a company can change the company name by passing a special resolution and notifying ASIC of the change. However, ASIC’s fee is currently $366 (as at 1 January 2014). Castle Corporate can assist with changing your company name - just complete and submit this order form to us.

-

How do I change my company name?

Company name changes are relatively common, and can be requested for many different reasons. To avoid confusion, the name of a company must be different to all other company and business names in Australia. We can help you change your company’s name. Simply complete this form and email it back to us.

-

What is an ACN?

Each company is allocated a unique Australian Company Number (ACN). Yours will be provided after your company is registered by ASIC. If you choose, you can use your ACN as your company name. When a company has been issued an ABN, the number will be the ACN with two additional leading digits resulting in an 11 digit number (eg, ACN 123 456 789, new ABN xx 123 456 789). Your ABN is issued by the ATO after your company has been registered. We would be happy to apply for an ABN on your behalf - simply complete this order form and return it to us.

-

Can I use my ACN as my company name?

Yes, you can register your company without a unique name and simply use the Australian Company Number (ACN) as the name for your company. What is an ACN?

-

Can I choose any name for my company?

Yes, you can choose your own unique company name. However, there are some restrictions that you need to be aware of when you are choosing a name. The first thing you will need to do is check to see if there are any other companies or business names already registered with an identical name. You can search for the company name you want here. In addition, it's important to note that there are restrictions for some words or phrases being used in company names. We recommend downloading Schedule 6 – Availability of names from ASIC. It contains a list of words that they reject. If you are very keen to use one of these words in your company name, please call us to discuss on 03 9898 6666. Can I use my ACN as my company name?

Self-Managed Super Funds

-

What can't my self-managed super fund invest in?

To maintain the regulated status of your fund (and its attendant concessional taxation rates), the Trustee must not allow any of the following to occur:

- No more than 5% of the market value of total assets of the fund may be invested in in-house assets.

- The fund is generally prohibited from borrowing funds, although some short-term exemptions apply in relation to special circumstances and, through the creation of a bare trust which satisfies the requirements of Section 67(4A) of the SIS Act, a borrowing may be undertaken for the benefit of the Fund.

- The fund is prohibited from lending funds to members or their associates.

- The fund can only purchase from members or their associates interest-bearing deposits (such as funds on deposit with cash management trusts, etc) or securities listed on an approved Stock Exchange. Some other assets may be purchased but special rules apply and advice should be sought.

-

Does my SMSF have to pay stamp duty?

Stamp duty on superannuation fund deeds is only required in Northern Territory and Tasmania. This table illustrates all stamp duty details.

-

Can a member of an SMSF be less than 18 years old?

Yes, a member can be under 18 in a super fund. If the under-age member does not have a nominated legal personal representative, a parent or guardian must act as trustee of the fund on their behalf. Where the SMSF has a corporate trustee, a parent or guardian is allowed to be a director of the trustee company in place of the underage member.

-

Can members of a super fund be non-Australian residents?

Yes, however there may be severe tax consequences if all fund members reside overseas for an extended period. We recommend seeking professional advice prior to establishing the fund if this will be your situation.

-

What are the advantages of a self-managed super fund?

Some of the advantages people see in running their own super fund are:

- they can have greater investment freedom

- they feel their money is safer being invested by them as trustees

- they can actively participate in the management of the fund

- there are reduced formal reporting requirements; and

-

What are the SIS Act conditions for a self-managed super fund?

Firstly, the SIS Act is short for Superannuation Industry (Supervision) Act 1993. It is the legislation that governs superannuation in Australia. For a superannuation fund to qualify as ’self-managed’, the following conditions must be met: 1. The fund must have less than 5 members. 2. Each individual trustee must also be a member of the fund. 3. Each director of a corporate trustee must also be a member of the fund. 4. Each member of the fund must be either a trustee of the fund, OR a director of the body corporate, if the trustee of the fund is a body corporate. 5. No member of the fund is an employee of another member of the fund, unless they are related. 6. No trustee can receive any remuneration from the fund or from any person for any duties or services as trustee. There are some exceptions to 2 and 3 above regarding sole member funds. A superannuation fund with only one member is a self-managed super fund if and only if: 1. If the trustee is a body corporate the member is the only director of the body corporate, OR the member is 1 of only 2 directors of the body corporate, and both directors are related to each other, OR the member is 1 of only 2 directors of the body corporate, and the member is not an employee of the other director. AND 2. If the trustees of the fund are individuals the member is 1 of only 2 trustees, of whom one is the member and the other is a relative of the member, OR the member is 1 of only 2 trustees, and the member is not an employee of the other trustee. AND 3. No trustee of the fund receives any payment from the fund or from any person for any duties/services performed by the trustee in relation to the fund. All above information has been sourced from the Superannuation Industry (Supervision) Act 1993 Sect 17A - Definition of self managed superannuation fund.

Discretionary trusts

-

Does your discretionary trust deed cover the issues raised in the Bamford case?

We are often asked if our trust deed encompasses the issues raised in the Bamford case. We are pleased to say yes. Castle’s investment in having good quality documents has paid off, and you will be pleased to know that all trust deeds issued by Castle define “income” very flexibly, so that it encompasses either a section 95 definition or an ordinary concepts definition, with the trustee being free to use such interpretation as best suits its purposes. To read more about the Bamford case and how we can help, read here.

-

What is a discretionary trust?

A discretionary trust is a structure that is commonly used to:

- allow for easy distribution of trust income and capital

- allow for distribution of funds to beneficiaries at the discretion of the trustee, and/or

- protect or ’quarantine’ assets from creditor attack.

-

Who are the beneficiaries in a discretionary trust?

The beneficiaries are the people (including entities) for whose benefit the trustee holds the trust property. A discretionary trust often has a wide range of beneficiaries, including companies and other trusts. The beneficiaries of a discretionary trust do not have an interest in the assets of the trust. They merely have a right to be considered until the trustee exercises its discretion to make a distribution. There are typically two types of beneficiary to a trust:

- A primary beneficiary is any entity that is named in the trust deed when it is created. These are entities specifically nominated to receive trust funds from the trustee.

- A ‘general’ beneficiary is typically a related entity to a primary beneficiary and can include grandparents, parents, siblings, children, stepchildren, grandchildren, nieces and nephews, cousins, etc.

-

What does the appointor do in a discretionary trust?

The appointor (which can be an individual, several individuals or a company) has the power to remove and appoint trustees (other than the initial trustee). This would commonly occur when:

- the trustee dies, becomes bankrupt or is incapacitated, or

- the company is wound up (if the trustee is a company).

- delegate its powers to another entity, and/or

- resign by giving written notice to the Trustee. On resignation, the appointor's notice may nominate its successor and if no successor is nominated, the trustee becomes the appointor.

-

What does the trustee do in a discretionary trust?

The trustee is the legal owner, not the beneficial owner, of the trust property. It is the responsibility of the trustee to administer the trust, including investing the trust funds and deciding to whom the distribution of trust income is to be made. Any decisions made by the trustee should be minuted and retained with the records of the trust. The trustee carries out all transactions of the trust in the trust’s name and must sign all documents for and on behalf of the trust. The trustee’s overriding duty is to obey the terms of the trust deed and to act in the best interests of the beneficiaries. The trustee may resign from its role by tendering its resignation to the appointor.

-

What does the settlor do in a discretionary trust?

The settlor (which can be an individual, several individuals or a company) is only involved in the establishment phase of the trust. The settlor invites the trustee to accept the position as trustee. Once the trustee has accepted the position, the settler gifts an amount of money (the ‘settlement sum’) to the trustee. The settlement sum is a nominal amount, usually $10 or $20. The settlor, his estate and any corporation or trust in which the settlor or his estate has any interest, may not be a beneficiary of the trust and ideally is not a member of the family for whom the trust is being established. The most suitable settlor is usually a friend of the family. Additionally, if somebody transfers or sells any asset to the trust for less than its full market value, that person becomes a notional settlor and is also prohibited thereafter from receiving any type of distribution from the trust.

Trusts

-

Does your discretionary trust deed cover the issues raised in the Bamford case?

We are often asked if our trust deed encompasses the issues raised in the Bamford case. We are pleased to say yes. Castle’s investment in having good quality documents has paid off, and you will be pleased to know that all trust deeds issued by Castle define “income” very flexibly, so that it encompasses either a section 95 definition or an ordinary concepts definition, with the trustee being free to use such interpretation as best suits its purposes. To read more about the Bamford case and how we can help, read here.

-

What can I do if I have lost all stamped copies of my trust deeds?

Unfortunately, signed trust deeds are not easily replaced. Once a set of trust deeds have been signed (and stamped, where required), they form the active trust and all original copies are forwarded to the client. Castle does not retain copies of signed trusts. If you require a copy of a trust deed that you have ordered from Castle before 1 January 2014, please give us a call on 03 9898 6666 and we may be able to assist.

-

Do you supply charitable trusts?

Yes, we can assist. Simply give us a call on 03 9898 6666 and we can speak with you about your requirements. If you require deductible gift recipient endorsement, some of the possible categories include:

- Health promotion

- Australian disaster

- Charitable services

- PBI

- Ancillary fund

- Private ancillary fund

- Scholarship

- Animal welfare

- Overseas aid

- Environmental organisation

- Cultural organisation

- Necessitous circumstances

-

Can a foreign resident be a trustee of trust?

Any natural person can be a trustee of a trust. Note that in Victoria, if the trustee remains out of Victoria for more than one year (which will be the case for a non-resident), the appointor may appoint one or more other persons to be trustee or trustees in place of the existing trustee. Therefore, it would be prudent for your client to also be the appointor of the trust to protect his interests and not be replaced as trustee.

-

Can I set up a trust with my company order?

Yes, simply place your order for your company first. Then fill in the trust order form. We can then use the ACN from your company to complete your trust order.

Common seals

-

Why are common seals no longer included in company packages?

As of 1 July 2014, Castle Corporate no longer offers common seals as a standard inclusion in our company packages. To explain the reasoning behind this change, we thought we would give you a little bit of background to the seal.

The history of the common seal

A common seal was once used as a form of proof by a company that it had formally and legally executed a document. Until 30 June 1998, the use of a common seal to execute solemn or formal documents was compulsory. However, as part of the Costello-led corporate law reform process, and as embodied in the Corporate Law Review Act 1998, the use of a common seal by a company was made optional. That Act stated that:"A company is not required to have a common seal. If it does, the seal must show the company's name and its ACN. The seal is equivalent to the company's signature and may be used on important company documents such as mortgages."

Many organisations took years to adjust to that new relaxation in the law. The worst offenders were government instrumentalities who, in some cases, did not accommodate that change for 8 to 10 years. Now, some 16 years later, the vast majority of organisations and individuals are familiar with, and comfortable about, accepting a document executed by a company without a common seal.Benefits of not using a common seal

The ordering of common seals when setting up a company has become less and less popular over the years. And for good reason. This new approach means:- lower costs for the company owners

- the ability to receive the company documentation faster

- no-one needs to worry about the location of the seal, and

- no need for ink pads and other inconveniences.

What if I still want to order a seal?

While common seals have become less popular, that does not mean we will stop offering them. Common seals can be ordered for an additional fee, either:- when ordering a company or a change of company name – simply select it as a package option on our company order form, or

- separately – send us an email to castle@castlecorp.com.au.

Proprietary Company

-

Why are common seals no longer included in company packages?

As of 1 July 2014, Castle Corporate no longer offers common seals as a standard inclusion in our company packages. To explain the reasoning behind this change, we thought we would give you a little bit of background to the seal.

The history of the common seal

A common seal was once used as a form of proof by a company that it had formally and legally executed a document. Until 30 June 1998, the use of a common seal to execute solemn or formal documents was compulsory. However, as part of the Costello-led corporate law reform process, and as embodied in the Corporate Law Review Act 1998, the use of a common seal by a company was made optional. That Act stated that:"A company is not required to have a common seal. If it does, the seal must show the company's name and its ACN. The seal is equivalent to the company's signature and may be used on important company documents such as mortgages."

Many organisations took years to adjust to that new relaxation in the law. The worst offenders were government instrumentalities who, in some cases, did not accommodate that change for 8 to 10 years. Now, some 16 years later, the vast majority of organisations and individuals are familiar with, and comfortable about, accepting a document executed by a company without a common seal.Benefits of not using a common seal

The ordering of common seals when setting up a company has become less and less popular over the years. And for good reason. This new approach means:- lower costs for the company owners

- the ability to receive the company documentation faster

- no-one needs to worry about the location of the seal, and

- no need for ink pads and other inconveniences.

What if I still want to order a seal?

While common seals have become less popular, that does not mean we will stop offering them. Common seals can be ordered for an additional fee, either:- when ordering a company or a change of company name – simply select it as a package option on our company order form, or

- separately – send us an email to castle@castlecorp.com.au.

-

What classes of shares do you allow for?

Nine classes of shares are provided for in all standard companies. This anticipates and prepares the company for various changes to the composition of shareholders and other changes which may arise over the life of the company, avoiding the need for (and expense of) creating the most commonly needed classes of shares in future years. The classes are:

- ordinary shares with all normal dividend and voting entitlements. This is the class of share most commonly used in all types of companies.

- A to F class shares – these all have the same right to receive a dividend at a rate different to that paid on the ordinary shares. These shares allow for dividend streaming. Although the holders of the same class of share must receive the dividends paid at the same rate, a different rate can be paid to the holders of different classes. For example, if there is a holder of A, B and C class shares, the holder(s) of A class shares may receive a dividend of 10 cents per share; those holding B class shares may receive no dividend; and those holding C class shares may receive a dividend of 50 cents per share. Those rates can be altered for each dividend payment. These shares do not confer any entitlement to vote.

- G and H class redeemable preference shares – these generally do not confer an entitlement to vote, but do confer an entitlement to receive dividends in priority to all other shareholders. These shares can be redeemed at the Company's option.

-

What is a public officer?

The public officer in a company is the primary contact for the Australian Taxation Office (ATO). You must advise the details of the public officer to the ATO within three months of commencing trade. This can be done when applying for your Australian Business Number (ABN).

-

Do I have to have a secretary?

Not for a proprietary company. Since 2000, the office of secretary has been optional for Australian proprietary companies. Even so, ASIC requires to be notified of an appointment or resignation of a company secretary. We can assist you. Simply fill in this form and email it back to us. However, public companies are still required to have one secretary who must reside in Australia.

-

What do company directors do? Can I just appoint a spouse or a friend as a director?

Directors are responsible for the proper and prudent operation of the company and are the primary decision-makers. Unless they will be actively involved with the business, it is usually not a good idea to appoint your spouse or friend as a second director of a company. It is important to note that when it comes to statutory duties and obligations, ignorance is not accepted as an excuse for non-compliance. If you wish to make any changes to the directors of a company, we can help. Simply fill in this order form and email it back to us.

-

Why does a director have to be resident of Australia?

It is a requirement under Section 201A of the Corporations Act (2001) that all Australian proprietary companies must have at least one director who resides in Australia. Because of this rule, ASIC will not allow a company to either be registered or owned by only foreign residents. You can view where the Corporations Act references this requirement here.

-

Can I form a company with one director?

Yes – for a proprietary company. Since December 1995, Australian proprietary companies have been allowed to register with a sole director (who must live in Australia). Public companies must have a minimum of three directors (two of whom must reside in Australia).

-

Do you provide a common seal? Do I need one?

Australian companies are not required to have or use a common seal. The requirement was removed in 1998. Many people continue to order common seals, but their popularity has declined over the last 10 years or so. However, if you would like a common seal, they come included in our Premium and Standard packages. If you do not want one, $16.50 will be deducted from your package fee. For our Electronic packages, you can choose to add one to your order for an additional $27.50.

-

What are the replaceable rules?

The replaceable rules are a collection of about 40 sections extracted from the Corporations Act 2001 that give a general framework for running an Australian company. These rules govern the internal relationships of officers and shareholders, but do not cover more practical rules relating to how a company is run on a day-to-day level. To read more about constitutions and the replaceable rules and to determine the suitability of both for your company, please read this page on the ASIC website: Constitution and replaceable rules.

-

Do you provide a constitution?

The constitution contains the rules and procedures that determine how the company is run, making it a very important document. All companies produced by Castle Corporate are provided with our up-to-date constitution in PDF format. If you choose our standard package, two bound copies of the constitution are included. Our premium package includes four bound copies. What are the replaceable rules?

-

Who can register an Australian company?

Practically anybody can register an Australian company, provided they comply with the ASIC Guidelines for registration. Primarily, you need at least:

- one resident director

- one shareholder, and

- a physical Australian address for the registered office of the company.

-

What are the legal elements of a company?

A proprietary company name must include one of the following legal element combinations:

- Pty Ltd

- Proprietary Limited

- Proprietary Ltd

- Pty Limited

- Pty. Ltd.

-

What makes a company, a company?

The general characteristics of a company are:

- it is a corporate body created by law

- it has all the powers of an individual and a corporation

- it can sue and be sued in its own right

- it has officeholders (director(s), secretary(ies))

- it has a registered office

- it has member(s).

Public company limited by guarantee

-

Why are common seals no longer included in company packages?

As of 1 July 2014, Castle Corporate no longer offers common seals as a standard inclusion in our company packages. To explain the reasoning behind this change, we thought we would give you a little bit of background to the seal.

The history of the common seal

A common seal was once used as a form of proof by a company that it had formally and legally executed a document. Until 30 June 1998, the use of a common seal to execute solemn or formal documents was compulsory. However, as part of the Costello-led corporate law reform process, and as embodied in the Corporate Law Review Act 1998, the use of a common seal by a company was made optional. That Act stated that:"A company is not required to have a common seal. If it does, the seal must show the company's name and its ACN. The seal is equivalent to the company's signature and may be used on important company documents such as mortgages."

Many organisations took years to adjust to that new relaxation in the law. The worst offenders were government instrumentalities who, in some cases, did not accommodate that change for 8 to 10 years. Now, some 16 years later, the vast majority of organisations and individuals are familiar with, and comfortable about, accepting a document executed by a company without a common seal.Benefits of not using a common seal

The ordering of common seals when setting up a company has become less and less popular over the years. And for good reason. This new approach means:- lower costs for the company owners

- the ability to receive the company documentation faster

- no-one needs to worry about the location of the seal, and

- no need for ink pads and other inconveniences.

What if I still want to order a seal?

While common seals have become less popular, that does not mean we will stop offering them. Common seals can be ordered for an additional fee, either:- when ordering a company or a change of company name – simply select it as a package option on our company order form, or

- separately – send us an email to castle@castlecorp.com.au.

-

I'm ordering a public company limited by guarantee. Can't I just use the replaceable rules instead of a constitution?

It is strongly recommended that a public company limited by guarantee does not rely on the replaceable rules. Instead, it is best to put in place a constitution to ensure that the governance of the company is carried out in accordance with the wishes of its members.

-

What are the rules for a director in a public company limited by guarantee? Can they be paid?

A public company must have three directors, with at least two ordinarily residing in Australia.

- Directors may be on rotation (where, every 2, 3 or 4 years, a director must retire and offer himself/herself for re-election). Alternatively, at your option, a director can be appointed on a permanent basis until resignation, death, removal, bankruptcy, etc. This should be set out in the constitution.

-

What are the membership rules for a public company limited by guarantee?

A public company must have at least one member, but there is no upper limit on its number of members. Any legal entity may be a member of the company.

- To become a member, a person must apply for membership, be approved and pay all appropriate membership/ subscription/annual fees (if any).

- Different classes of membership may be created to serve the company’s purpose(s) better.

- Members may be subject to disciplinary procedures and may lose their membership status (either temporarily or permanently).

- Members must agree to contribute an amount of money (often an amount between $10 and $100) should the company be wound up and if there are insufficient assets to cover liabilities.

Unit trusts

-

Who is the trustee of a unit trust?

In a unit trust, the trustee has the responsibility of running the trust, along with the distribution of trust income and capital. Any assets held by the trust are held in the name of the trustee, in its capacity as trustee of the trust. A trustee may at any time resign by serving its resignation to the unit holders.

-

What is a unit holder?

A unit holder can be either one or more people, a company, a trustee of a family trust or any other trust or a combination of them all. Much like shares held in a company, units held by a unit holder carry certain rights (the right to receive distributions of income and capital and the right to vote at unit holder meetings). Some decisions that must be made by the trustee with regards to the operation of the trust must have the consent of the unit holders before they can proceed. These can include changes to the ownership of the trust, changes to the trust deed and changing the trustee. Minors under law cannot hold units in a unit trust.

-

What is a unit trust?

A unit trust is a structure that is commonly used:

- when several people wish to start a business or investment scheme

- if the initial unit holders are likely to change over time

- for the distribution of trust income and capital that will be based at a particular rate according to the number/percentage of units held.

-

What's the point of classifying units in a unit trust?

There can be many advantages in classifying the units in a unit trust. It can allow for a more precise regulation between the unit holders (for example, a quorum for a meeting of unit holders may need to comprise one person representing the A Class unit holders and a second person representing the B Class unit holders; etc). Additionally, special rights can be attached to classes of units. The most popular right is for there to be a class of unit to which is attached discretionary income rights. This enables the Trustee of the unit trust to distribute income at the Trustee's discretion to one, some or all of the holders of such units, in priority to - or ranking behind - the distribution of income to holders of units where the distribution is fixed. Other rights which may be attached to different classes of units include:

- voting rights, and/or

- rights to capital distributions.

Voluntary liquidation

-

How can I voluntarily liquidate my company?

When a company is no longer required, it can be wound up. This procedure may be used only if a company is solvent. The procedure is lengthy and complex with the requirement to hold general meetings, place four advertisements, provide advice to ASIC and the Australian Taxation Office, etc. If a company has no assets other than cash - or if its assets can be distributed in specie - the company's dissolution can occur within 5 months. Most of this time is needed to observe statutory delays following the placement of advertisements and the lodging of forms with the ASIC. Castle can assist with this – just give us a call on 03 9898 6666. All you will need to do is sign the paperwork we prepare for you and arrange for one members' meeting and one directors' meeting. As a generality, these meetings are not actually held, but are simply recorded as having been held.

Voluntary deregistration

-

What is the procedure for voluntary deregistration?

To voluntarily deregister a company, you must apply to ASIC. Approval is generally automatic. ASIC batches up a large number of deregistration applications for publication in the Government Gazette. This can mean that the publication of the deregistered company’s name in the Gazette can take up to 2 months as ASIC waits for an acceptable number of companies. The dissolution of the Company will be officially in effect 2 months after the company's name is published in the Government Gazette. Therefore, the total time it takes to deregister a company is normally about 5 months. Companies no longer need to apply for deregistration to advertise their intention to deregister in a daily newspaper. It is important to note that deregistering a company is no protection against possible creditor litigation. The Corporations Act permits an aggrieved creditor to sue a company without the need for its reinstatement. To apply for voluntary deregistration, simply fill in our order form and submit it to us. We’ll be happy to help. What is voluntary deregistration?

-

What is voluntary deregistration?

When a company is no longer required and when there are no retained profits or assets, the most effective way to dispose of the company is to apply for its deregistration. In order to qualify for deregistration, all of the following conditions need to be met:

- all members agree to the deregistration

- the company is not carrying on business

- the company's assets are worth less than $1,000

- the company has paid all fees and penalties payable under the Corporations Act

- the company has no outstanding liabilities, and

- the company is not a party to any legal proceedings.

Company restructures

-

What is the normal process for a capital reduction?

Normally, a capital reduction occurs as follows: 1. Directors meet to convene a general meeting at which they put forward the resolution approving the capital reduction. 2. The secretary issues notices of the general meeting to all shareholders. Attached to that notice must be the wording of the proposed resolution and all matters which the company believes would be relevant to adequately inform the shareholders prior to asking them to decide upon the resolution. 3. ASIC must receive a copy of the notice of general meeting, together with all papers issued to shareholders. 4. The general meeting takes place so that shareholders can vote upon the proposed capital reduction. 5. Settlement of the transaction should next take place. This normally will involve either the company drawing a cheque in favour of the participating shareholders, or the cancellation of shares, if applicable. Cancellation is not mandatory. 6. Notice of resolution and cancellation of shares (if applicable) must be sent to ASIC. There is a set timetable to follow with this procedure. You are ‘locked into’ observing certain timeframes. All up, the procedure is usually completed within six weeks. If you would like to do a capital reduction, simply fill in our order form and submit it to us. We’ll be happy to help.

-

What is the procedure for a share buy back?

A share buy back generally proceeds as follows: 1. Directors meet to convene a general meeting at which they put forward the resolution approving the share buy back. 2. The secretary issues notices of the general meeting to all shareholders. Attached to that notice must be the wording of the proposed resolution and all matters which the company believes would be relevant to adequately inform the shareholders prior to asking them to decide upon the resolution. Included in these attachments must be a copy of the proposed Share Sale Agreement between the company and those shareholders involved in the share buy back. 3. ASIC must receive a copy of the notice of general meeting together with all papers issued to shareholders, including a copy of the proposed Share Sale Agreement. 4. The general meeting takes place so that shareholders can decide upon the proposed share buy back. 5. Settlement of the transaction should next take place, where the Share Sale Agreement and Share Transfer Form are executed. In Victoria, no stamp duty is payable on these instruments. If the company is incorporated in another state, duty may be payable. 6. Notice of transfer and cancellation of shares to be sent to ASIC. There is a set timetable to follow this procedure. You are ‘locked into’ observing certain timeframes. All up, the procedure is usually completed within two months. If you would like to start a share buy back, simply fill in our order form and submit it to us. We’ll be happy to help.

-

What types of shares can I buy back?

The ability for a company to easily buy back shares it had previously issued was introduced in 1995. As from this date, it was no longer necessary to undergo complex procedures or to re-draft the Memorandum and Articles of Association of the Company. A company is permitted to buy back any type of share other than redeemable preference shares. For an unlisted company, a buy back is generally either:

- Selective - whereby the treatment of shareholders differs, or

- Equal access - whereby all shareholders participate equally in the buy back scheme.

-

What is the difference between beneficially held and non-beneficially held shares?

When a legal entity owns shares for its own benefit, this is called a ‘beneficial holding’. A ‘non-beneficial holding’ is when another legal entity holds shares on another’s behalf. For example:

Beneficial holding Non-beneficial holding A child under the age of 18 A parent or guardian A trust The trustee A superannuation fund The trustee A partnership All partners or the managing partner -

What classes of shares do you allow for?

Nine classes of shares are provided for in all standard companies. This anticipates and prepares the company for various changes to the composition of shareholders and other changes which may arise over the life of the company, avoiding the need for (and expense of) creating the most commonly needed classes of shares in future years. The classes are:

- ordinary shares with all normal dividend and voting entitlements. This is the class of share most commonly used in all types of companies.

- A to F class shares – these all have the same right to receive a dividend at a rate different to that paid on the ordinary shares. These shares allow for dividend streaming. Although the holders of the same class of share must receive the dividends paid at the same rate, a different rate can be paid to the holders of different classes. For example, if there is a holder of A, B and C class shares, the holder(s) of A class shares may receive a dividend of 10 cents per share; those holding B class shares may receive no dividend; and those holding C class shares may receive a dividend of 50 cents per share. Those rates can be altered for each dividend payment. These shares do not confer any entitlement to vote.

- G and H class redeemable preference shares – these generally do not confer an entitlement to vote, but do confer an entitlement to receive dividends in priority to all other shareholders. These shares can be redeemed at the Company's option.

-

Who can hold shares in a company?

Any legal entity may hold shares in a company. A legal entity can be defined as, “any person, company or incorporated association which is resident anywhere in the world.” However, a minor under law cannot hold shares in their own name.

ABNs - Business names

-

What if I have already registered my business name?

When you apply to register a company, you have the opportunity to enter the registration number or ABN of your business name into our order form. This helps ASIC identify the business name as belonging to you so they will approve the registration of your company with a name identical to your business name. The owner(s) of the business name must be officer(s) or member(s) of the proposed company.

-

Does my order include an ABN and a TFN?

No. You will need to apply for your tax file number separately from the ATO. You can apply for one online here. ABNs on the other hand are not mandatory, though a company does require one before it can trade and before it can register for GST. When placing your order, you can select for us to apply for an ABN on your behalf for an additional fee.

Uncategorised

-

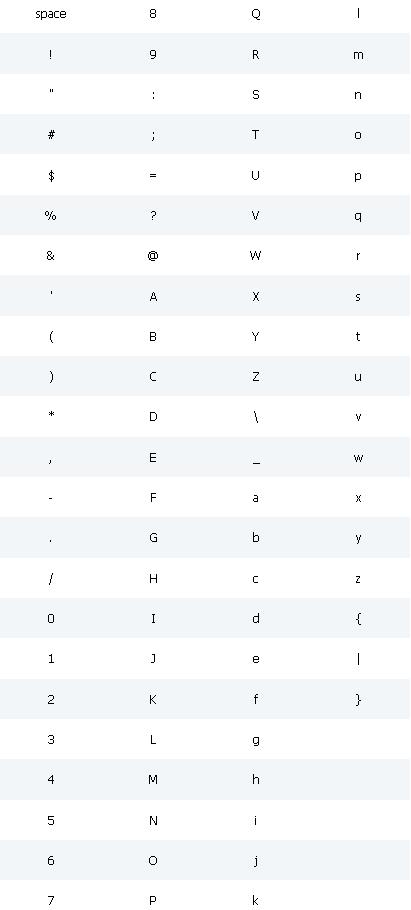

What are the 'valid characters' that ASIC allows in a company name?

ASIC accepts all numbers, upper and lower-case letters as well as the prescribed special characters noted in the table below (sourced from ASIC on 10 February 2015). Note that ASIC will not allow you to use any accented characters, for example: ç, è, é, á and ü.

-

What is stamp duty and where do you have to pay it?

Stamp duty is a tax imposed by certain States on documents or transactions that affect or record:

- the transfer of the ownership of assets (eg land, cars), or

- the creation of rights in respect of assets (eg certain leases and the creation of a trust).

State/Territory

Discretionary & Unit Trusts

Super Funds

Duty Payable on Original

Duty Payable per Counterpart

Must Be Stamped Within

ACT No No - - - New South Wales Yes No $500 $10 90 days from date of deed Northern Territory Yes Yes $20 $5 60 days from date of deed Queensland No No - - - South Australia No No Nil - but deeds will be stamped if requested Nil - but deeds will be stamped if requested - Tasmania Yes Yes $50 $0 90 days from date of deed Victoria Yes No $200 $0 30 days from date of deed Western Australia No No - - -